Summary

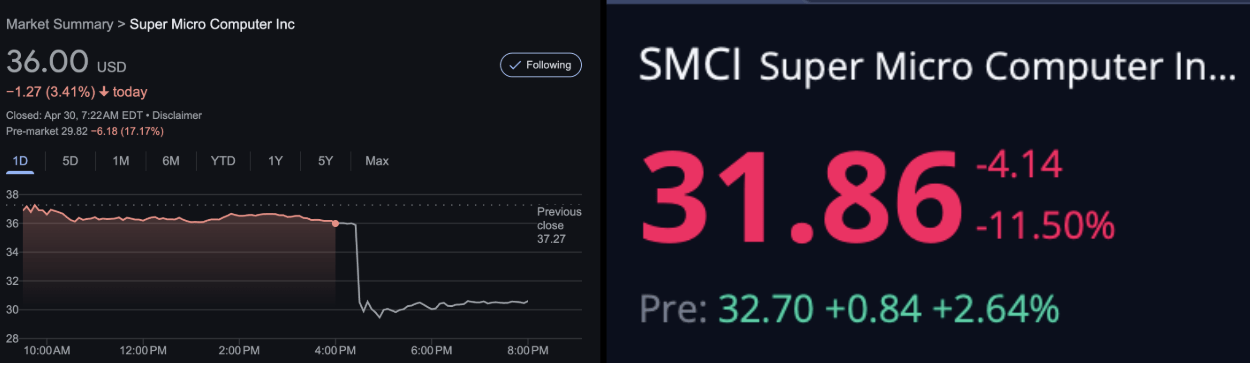

- Super Micro Computer, Inc. plunged 17% pre-market and closed 11% Wednesday on lower Q3 revenue and EPS, and we don’t think this will be the last disappointment of the quarter.

- SMCI cited delayed customer decisions and higher inventory reserves of older generations for the Q3 miss.

- We think the weakness of Q3 is priced in, but the potential miss on FY25 isn’t; SMCI needs to print >$7B to hit its FY25 outlook of $23.5B to $25B.

- We see a higher risk profile for SMCI stock on more potential disappointment when it comes to the FY25 outlook and Nvidia’s likelihood of a worse-than-expected July quarter guide.

- Looking for a portfolio of ideas like this one? Members of Tech Contrarians get exclusive access to our subscriber-only portfolios. Learn More »

skynesher/E+ via Getty Images

Super Micro Computer, Inc. (NASDAQ:SMCI) took a nosedive Wednesday, crashing 17% in pre-market trading and closing 11% lower for the day after reporting preliminary results Tuesday after the bell; the company is showing the latest hit for the server industry, trailing Wall Street expectations big time with EPS of $0.29 to $0.32 almost half of estimates for $0.54 and revenue of $4.5B to $4.6B, around $1B lower than the expected $5.5B. Here’s management’s explanation:

During Q3, some delayed customer platform decisions moved sales into Q4…higher inventory reserves resulting from older-generation products.

This tells us that demand for H100, and the broader Hopper series, is not what it used to be. In fact, inventory levels are likely higher on H100 reserves, meaning SMCI can’t get H100 off the shelves and is taking a hit because of that, and its gross margins will contract a whopping 220 basis points, too.

TSP

So, let’s walk through what this tells us.

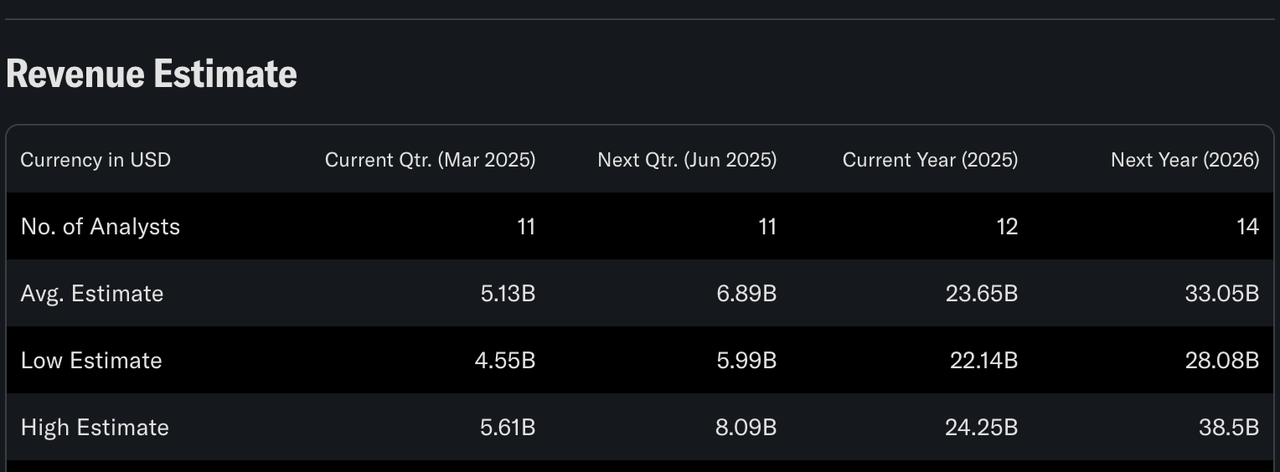

#1 SMCI’s visibility is bad to non-existent

Let’s take a walk down memory lane. So, back in February, SMCI cut their FY25 guide, for the year that ends June 30th, from $26B to $30B, to $23.5B to $25B. CEO Charles Liang stated that the company’s liquid cooling is expected to continue performing well over the next 12 months, which should enable the company to reach sales of $40B in FY26. Significantly higher than the $29.18B expected by Wall Street at the time. Now, we think SMCI actually has little to no visibility on the demand environment if they’re undercutting their guidance for the second time in the span of three months. SMCI is unable to stick to their original outlook because of customer behavior, but somehow are guiding for FY26 to be $40B, although the year ends in June 2026. It doesn’t make sense to us that they have visibility that far out, but their near-term visibility, which should be stronger, has fallen through again. The chart below shows Street estimates for SMCI’s sales this quarter and for FY25 and FY26.

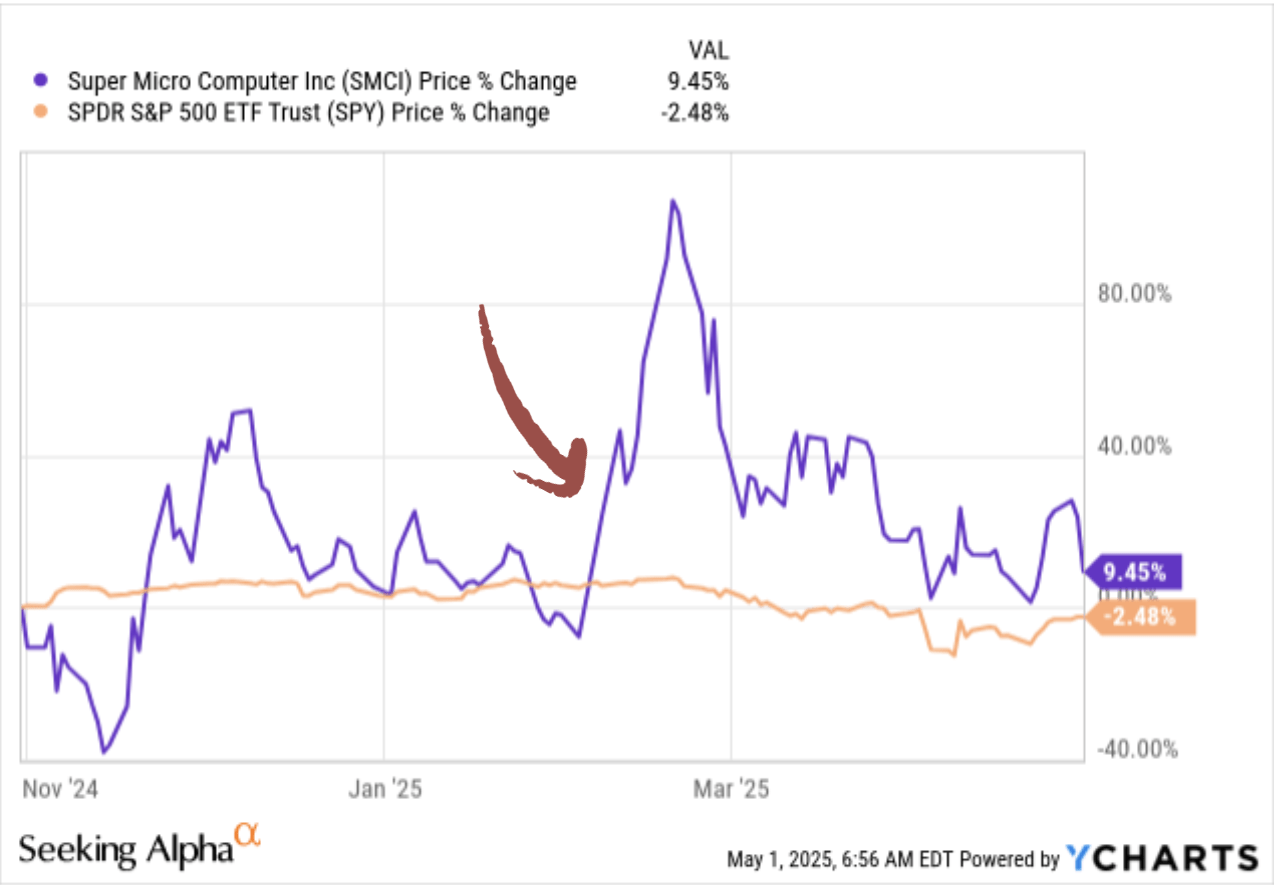

This second letdown set the stock up for its worst day since it cut its guidance in February. Now, after the FY25 guidance cut in February, the stock had a massive comeback, as shown below, which tempted us to initiate a buy call for a quick trade, but the fundamentals signal too high a risk.

YChart

#2 The high risk is on another miss

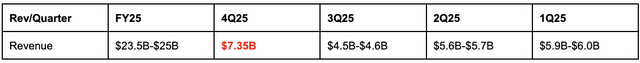

The thing that pushed us to initiate a sell even after the sell-off yesterday is the fact that SMCI may not hit its lowered FY25 outlook. The chart below showcases SMCI’s reported revenue ranges for FY25 and thus far, if we calculate the midpoint revenue of each quarter, we’d find that to hit the low end of the $23.5B to $25B outlook for FY25, SMCI would have to report $7.35B in Q4. And as of now, we don’t see signs of that being possible. If SMCI had achieved its original guide for Q3 for the range of $5B to $6B for the quarter on EPS of $0.46 to $0.62, hitting the FY25 target could be possible. But the preliminary results signal there may be another cut in guidance this quarter.

#3 SMCI stock could drop if Nvidia misses July quarter outlook

We think SMCI stock could also trade lower if our thesis on Nvidia (NVDA) guiding lower than expected for the July quarter plays out. Hence, we see too much downside risk into the end of May to advise investors to buy the stock, even though the sell-off makes for a tempting case. Nvidia is going to tell us the July quarter guide on May 28th, and this should provide more clarity.

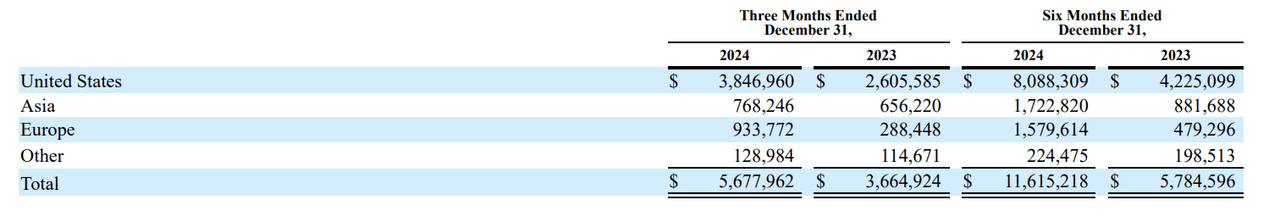

We also suspect that SMCI could be exposed to the new licensing requirements of H20, and that could have impacted their higher inventory level for the quarter. Keep in mind that while SMCI doesn’t tell us their exact sales to China, we know that sales to Asia are the second-largest region after the U.S., shown below from last quarter’s 10Q. So, we suspect that maybe we saw some impact there as well from regulation shifts.

We’re not too worried about financial filing impacting SMCI’s fundamental business, but it could impact the stock

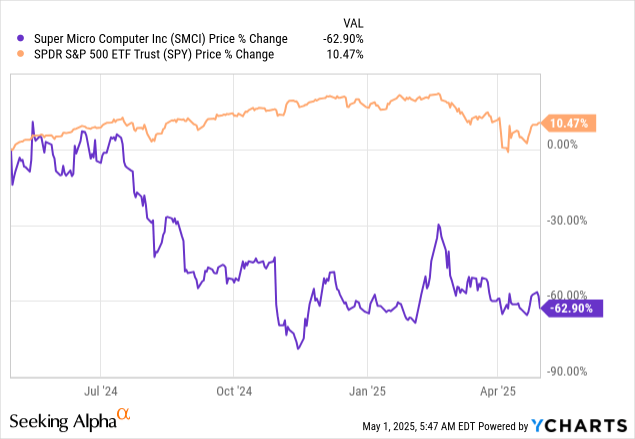

SMCI has been in limbo when it comes to the company’s financial reporting; it delayed its annual report and auditors, and Ernst & Young resigned; the stock took a hit on all the news, with SMCI selling off last year, down almost 63% over the past year versus the S&P 500 (SP500) up 11%. Since then, things have improved, with the company signing on a new auditor back in November and then guiding higher for FY26. What the events of 2H24 taught us is that SMCI’s customer base is not threatened by financial error concerns; the best the chatter does is pull back the stock to more attractive levels.

YCharts

Our belief is that the other threat to SMCI is pricing pressure from competition, specifically if other Taiwanese ODMs can do what SMCI does with lower margins. We already know that SMCI and Dell (DELL) have some competitive pricing that pressures each other. This could pose additional risk to SMCI aside from the already existing concern about a slowdown in AI infrastructure spend.

The bottom line:

SMCI is scheduled to report its official earnings on May 6th, i.e., next week, and we should get more clarity on what management’s take is on the demand environment. We think the fundamentals point to a slowdown, but we also know that in the past, SMCI has shown a trend of bouncing back after pricing in negatives on investor hope that the AI growth story is alive and well. The stock should provide more favorable exit points after Meta Platforms (META) and Microsoft (MSFT) reported Wednesday, surging 6% and 9%, respectively, in pre-market trading, signaling to the broader market that AI spend and demand remain healthy. We think investors should take advantage to exit the stock and jump in after the risk on FY25 is priced in.

Don’t just invest—dominate with Tech Contrarians’ realized return on closed positions of 65.8% since inception. You’ll get exclusive insights into high-focus stocks, curated watchlists, one-on-one portfolio consultations, and everything from live portfolio tracking to earnings updates on 50+ companies. Subscribe today for 20% off.

And remember, be the first to know, not the last to react.