Summary of Rigetti Computing Q1 2025 Performance

Rigetti Computing, Inc. (RGTI) reported a mixed financial performance for the first quarter of 2025, underlining challenges in achieving anticipated revenue targets while showing some improvement in losses per share. The company recorded a loss of $0.08 per share, which fell below market expectations of a $0.05 loss. This marks an improvement compared to the $0.14 per share loss reported in the same quarter last year, highlighting some progress on reducing overall losses.

Key Figures:

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $1.47 million | $3.05 million |

| Loss Per Share | $0.08 | $0.14 |

| Consensus Revenue Estimate Miss | 40.16% Below | — |

| Earnings Surprise | -60% | — |

The total quarterly revenue of $1.47 million represents a 51% decline compared to the same period last year, showcasing challenges in maintaining growth. This performance fell short of the Zacks Consensus Estimate, which anticipated higher revenue figures. Over the past year, Rigetti has not consistently exceeded consensus earnings or revenue predictions, achieving this milestone only once in the last four quarters.

Rigetti Computing’s business activities center on advancing quantum computing technologies through its superconducting qubit architecture and solutions like the Rigetti Quantum Cloud Services. The first quarter revenue results emphasize the competition and technical hurdles associated with scaling quantum-classical computing systems. Among its noteworthy achievements, Rigetti continues progressing toward developing a utility-scale quantum computer (USQC) and refining technologies such as quantum error correction (QEC).

The company’s earnings history also underscores ongoing investments in innovation. This includes work on the Novera QPU, expanding chip fabrication processes, and enhancing optical control methods for qubit signal processing. These developments align with Rigetti’s modular approach to creating systems capable of achieving high performance and stability standards, such as desirable iswap gate fidelity and FSim gates for optimized quantum operations.

Despite the revenue decline, Rigetti’s improved net loss figures highlight strategic cost management, though operating expenses and liabilities like warrant liabilities and earn-out liabilities remain challenges. Efforts toward securing government contracts, advancing strategic partnerships, and improving cash position through investments are essential moving forward. Cash equivalents and ongoing collaborations will be critical as Rigetti competes in advancing superconducting circuits for quantum systems.

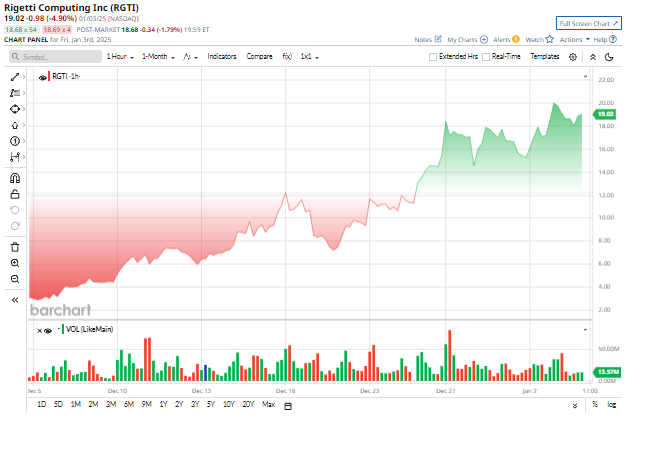

Recent Stock Activity:

- Rigetti’s stock has dropped by approximately 30.7% since the start of the year.

- Compared to broader market trends, such as the S&P 500’s 3.8% decline, this performance highlights growing investor concerns about near-term growth.

For the coming quarter, expectations hinge on management comments during earnings calls and how well the company navigates evolving market pressures. Current projections forecast a loss of $0.06 per share on revenues of $3.16 million, indicating potential modest growth relative to Q1. Future results will likely rely on progress against technology milestones, partnerships, and improvements in quantum preconditioning algorithms for applications like energy grid optimization.

Frequently Asked Questions

What are Rigetti Computing’s latest financial results?

Rigetti Computing recently shared its performance for the first quarter of 2025. The company disclosed a significant revenue miss, with reported earnings notably below expectations. More details can be viewed on Rigetti Computing Reports First Quarter 2025 Financial Results.

Has there been any recent news about Rigetti Computing’s operations or business strategies?

Rigetti has announced plans to advance into a six-month development phase for its utility-scale quantum computer concept, referred to as Stage A. This phase is aimed at enhancing performance and could bring substantial funding opportunities. Additional details are available through Rigetti Computing Reports First Quarter 2025 Financial Results.

What are the current trends and forecasts for Rigetti Computing’s stock performance?

Stock performance trends for Rigetti Computing have been influenced by its recent earnings report, which included revenue falling short of projections by over 40%. Analysts and investors are closely watching how the company navigates its strategic goals moving forward. Key updates on timelines and stock activity can be found via Rigetti Computing, Inc. Common Stock Earnings Report.

Have there been any announcements of layoffs or staffing adjustments at Rigetti Computing?

No publicly available information specifically mentions workforce restructuring or layoffs at Rigetti Computing recently. Stakeholders continue to monitor any operational updates provided by the company.

How does Rigetti Computing’s financial state compare to other companies in its sector?

Rigetti Computing faces stiff competition in the quantum computing market. Its recent financial results reflect challenges in revenue generation, but comparisons among peers are largely based on financial reporting, growth strategies, and technological advancements. For corporate insights, the Investor Relations page for Rigetti Computing may be informative.

What have financial analysts said about investing in Rigetti Computing?

Analysts have shown mixed reactions following the company’s latest earnings report. Concerns primarily center on missed revenue expectations, although some express optimism regarding Rigetti’s focus on developing scalable quantum computing solutions. Investor discussions are framed around the growth potential of the quantum computing industry. Relevant financial commentary is summarized on platforms like Yahoo Finance.