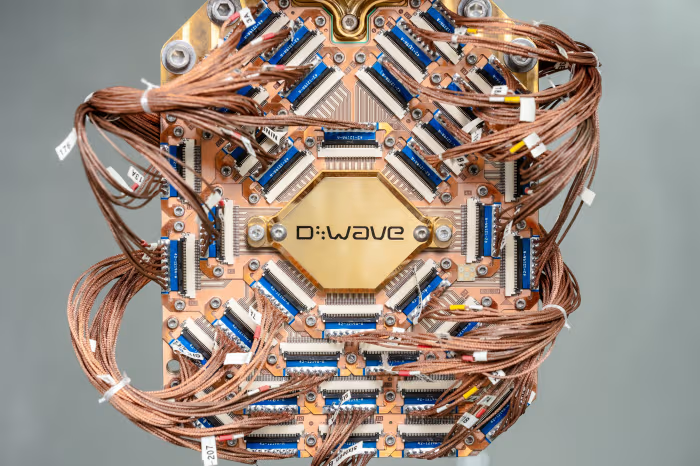

Quantum computing has become a hot topic in the technology world, with many investors looking for opportunities to capitalize on this emerging field. One company that has caught the attention of investors is D-Wave, a leader in quantum computing technology.

D-Wave has been making significant strides in the development and commercialization of its quantum computing systems, which use a different approach called annealing. This method harnesses the power of particles to solve complex problems and is seen as a potential game-changer in the industry.:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2219029330-e40a2934f19347018625d4a6e427071d.jpg)

But what makes D-Wave stand out from other companies in the quantum computing space? Let’s take a closer look at their technology and what sets them apart.

History and Background

D-Wave was founded in 1999 with the goal of applying quantum computing to real-world problems. The company has since grown to become a pioneer in the field and has received significant backing from some of the top tech giants, including Amazon, Google, and Goldman Sachs.

Unlike other quantum computing companies, D-Wave’s technology is based on annealing, a process that involves manipulating the state of particles to find the optimum solution to a given problem. This approach allows for faster problem-solving and better scalability, making it an attractive option for commercial applications.

Recent Developments

In recent years, D-Wave has made significant advancements in its quantum computing technology, including the launch of its newest machine, the Advantage™ quantum computer. This system boasts 5,000 qubits, making it the largest and most powerful commercially available quantum computer to date.

🧭 Overview: Two Paths to Quantum Leadership

D‑Wave Quantum (QBTS) has pioneered quantum annealing since 1999. Its Advantage2 system with 4,400+ qubits excels at optimization and has proven commercial traction aol.com+15investors.com+15nasdaq.com+15.

IonQ (IONQ) takes a gate‑model approach using trapped‑ion qubits. It’s rapidly scaling—surpassing 100 qubits—and targets universal computing applications .

📈 Recent Performance Snapshot

D‑Wave:

In Q1, revenue surged 509% year-over-year to $15 M, with non-GAAP loss shrinking to $0.02/share finviz.com+2investors.com+2nasdaq.com+2.

Closed the quarter with $304 M in cash, signaling a clear path toward profitability investors.com+12investors.com+12finviz.com+12.

Q1 earnings announcement triggered a 50% stock rally, topping $10 barchart.com+9investors.com+9barrons.com+9.

IonQ:

Reported $7.6 M in Q1 revenue, with full-year guidance forecasting $75–95 M finviz.com+1nasdaq.com+1.

Narrowed non-GAAP loss from $0.19 to $0.14/share year-over-year finviz.com+1nasdaq.com+1.

Acquired Oxford Ionics and Lightsynq to accelerate growth en.wikipedia.org+3finviz.com+3nasdaq.com+3.

⚙️ Tech Comparison: Annealing vs Gate‑Model

| Feature | D‑Wave Quantum (Annealing) | IonQ (Gate‑Model) |

|---|---|---|

| Qubit Count | 4,400+ Advantage2 qubits | 100+ trapped-ion qubits |

| Primary Use Case | Optimization (e.g., logistics, finance) | Universal computing & algorithm flexibility |

| Business Model | Commercial annealing systems via cloud | Cloud access, enterprise systems, scale‑up |

| Profit Path | Near-term commercial profit goal | Scaling revenue to near‑term profitability |

| Patents/IP | Large patent portfolio (~4,400 qubits) | Broader IP base (~950+ patents) barrons.com+14finviz.com+14nasdaq.com+14fool.com+2kiplinger.com+2fool.com+2en.wikipedia.orginvestors.com |

| Market Exposure | QUBTS: +121% YTD; strong commercial use | IONQ: +410% YTD; solid revenue growth |

🔮 Investment Pros & Cons

Market pioneer: 25+ years in commercial quantum systems investors.com.

Revenue momentum: 500%+ growth with Q1 earnings beat investors.com.

Solid capital reserves buttress near-term profitability ambitions .

Annealing suitable for specific optimization use cases; leading in that niche .

Annealing use cases may limit general-purpose appeal.

Industry scrutiny over performance vs gate-models persists.

Universal gate-model platform with broad computational potential investors.com+1barrons.com+1.

Rapid revenue and loss reduction rates .

Strategic acquisitions enhance scale and IP fool.com+3finviz.com+3barrons.com+3.

Backpatted as long-term “NVIDIA of quantum” candidate aol.com+3nasdaq.com+3investors.com+3.

Still unprofitable; long-term margins hinge on scale continuing fool.com+15fool.com+15investors.com+15.

Gate-models face hardware scaling and error-correction challenges.

🌐 Sector Context & Market Drivers

Quantum momentum rose after Nvidia’s CEO called the space “at an inflection point,” giving both QUBT (+4%) and IONQ (+5%) a boost barrons.comfool.com+7investopedia.com+7finance.yahoo.com+7.

A broader rally in quantum shares also followed after early gains from Google’s Willow breakthrough kiplinger.com+1barrons.com+1, setting positive sector tone.

✅ Verdict: Which Is the Smarter Pick?

D‑Wave offers stronger revenue, lower near-term risk, and focused annealing applications—ideal for risk-averse investors seeking near-viability.

IonQ presents higher growth potential via gate-model versatility—but carries scaling and profitability uncertainty.

Best strategy for speculative investors: diversify across both or hedge with quantum ETFs like QTUM, which include both stocks plus exposure to Alphabet, IBM, and Microsoft finance.yahoo.com+2marketwatch.com+2barrons.com+2fool.com+11kiplinger.com+11finviz.com+11barchart.com.