Quantum computing has been making huge waves in the investment community,

with one particular stock stealing the spotlight. On Wednesday, QUBT, the only publicly traded pure-play quantum computing stock, experienced a staggering 25% jump in its stock price. This unexpected surge has left many investors wondering what’s next for this cutting-edge technology company.

But before we dig into the stock’s recent movements, let’s first explore what quantum computing is all about. Quantum computing is a revolutionary technology that utilizes the principles of quantum mechanics to store and process information. Unlike traditional computers that operate using bits, quantum computers use quantum bits, or qubits, which can exist in multiple states simultaneously. This allows for complex calculations to be done at an unprecedented speed, making quantum computing a game-changer in various industries like finance, healthcare, and defense.

Now, back to the stock. QUBT has been on the radar of many investors since its IPO in March. And with the recent price surge, it’s no surprise that the stock’s trading volume has also increased significantly. So, what caused this jump in QUBT’s stock price?

Experts believe that the rise in the stock’s value is due to the company’s latest announcement of its partnership with IBM. The collaboration aims to develop Quantum Asset Management Solutions, a new financial platform powered by quantum computing. With IBM’s vast resources and expertise in the financial sector, this partnership could potentially unlock new capabilities and revenue streams for QUBT.

🔥 What Sparked the Jump?

Nvidia CEO Jensen Huang declared at the GTC conference: quantum computing is at an “inflection point”, reversing earlier 15–30-year forecasts axios.com+7investopedia.com+7m.economictimes.com+7.

The market reacted swiftly:

Quantum Computing Inc. (QUBT) soared ~25% to roughly $19, reaching its highest level since last December .

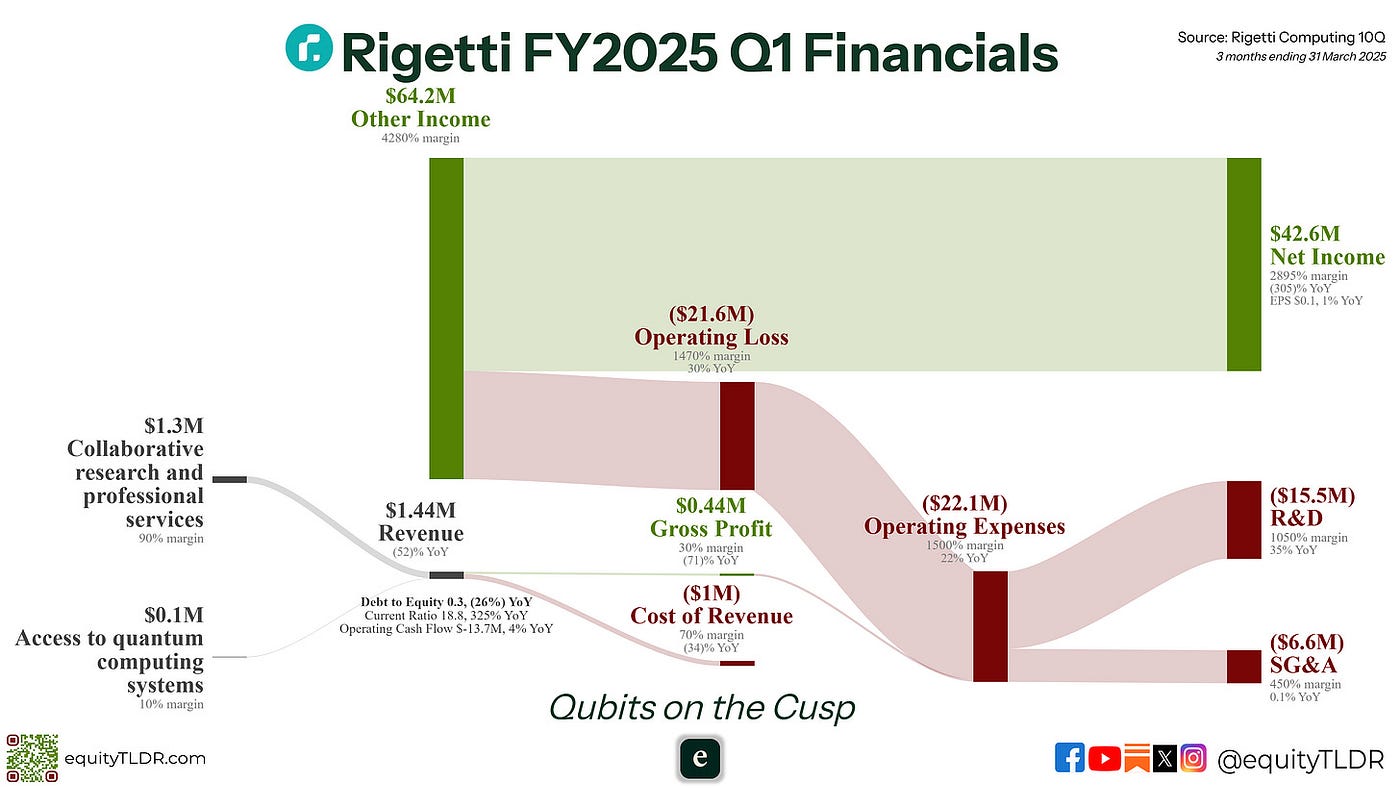

Other players like Rigetti (+11%), IonQ, and D-Wave also spiked, reflecting broad enthusiasm finance.yahoo.com+7investopedia.com+7finance.yahoo.com+7.

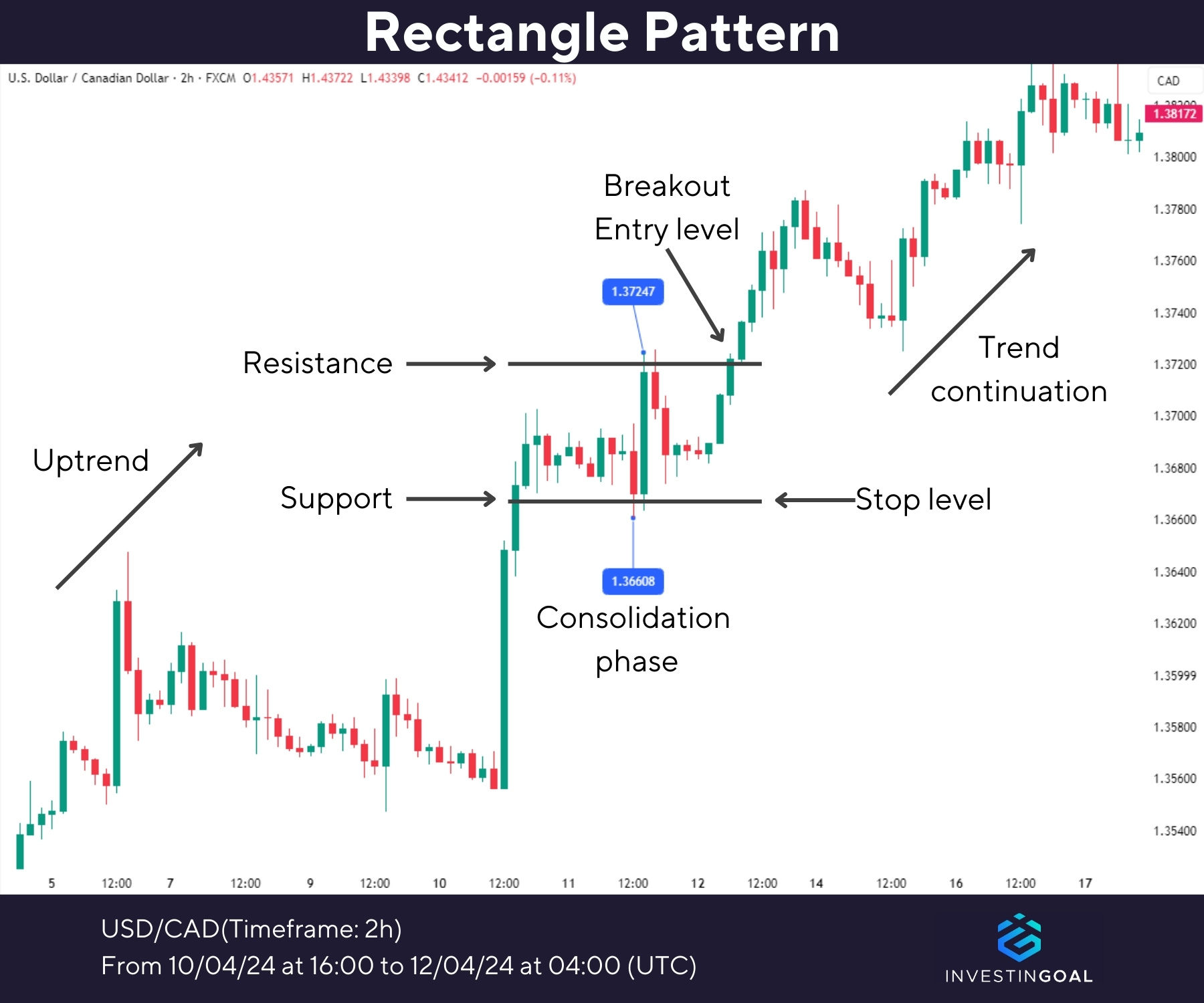

📈 Explosive Momentum & Technical Setup

Chart breakout: QUBT broke out of a rectangle formation—a bullish continuation pattern—with strong volume and a rising RSI, though the current reading suggests it’s slightly overbought investopedia.com+6investopedia.com+6finance.yahoo.com+6.

Support & resistance zones to track:

Support: $15 marks the rectangle’s top and a 200-day trendline—potential dip-buy area.

Deeper floor: $9 aligns with the 50-day MA and long-term trendline axios.com+2investopedia.com+2finance.yahoo.com+2.

Resistance: Near-term near $27 (December highs); if momentum continues, measured move targets could reach $37.50, nearly doubling from current levels investopedia.com.

⚖️ Risks & Market Sentiment

High volatility: QUBT share price has surged over 3,000% in the past year, making it a classic high-risk, high-reward investment investopedia.com+6m.economictimes.com+6investopedia.com+6.

Overbought caution: The RSI flag suggests a short-term pullback is possible following such a sharp rise .

Momentum vs Fundamentals: QUBT has limited earnings and remains speculative—making it vulnerable to sentiment shifts google.com+6m.economictimes.com+6investopedia.com+6.

🌐 Sector-Wide Tailwinds

IonQ’s strategic acquisition of Oxford Ionics and collaboration with Nvidia added momentum across the sector investopedia.com+4investopedia.com+4m.economictimes.com+4.

IBM’s roadmap for fault-tolerant systems by 2029 offers a long-term boost to industry credibility .

🧭 What to Watch Next

Catalysts: Nvidia follow-through, IonQ deal progress, IBM system updates.

Key price zones: Monitor pullbacks toward $15 or deeper toward $9, and watch whether QUBT can breach $27 or trend toward $37.50.

Diversify risk: High volatility suggests pairing QUBT with broad quantum ETFs like QTUM or mega-cap names like Rigetti, IonQ, or IBM for balance investopedia.com.

✅ Final Take

QUBT has surged on sector enthusiasm and technical momentum, but caution is warranted. Support zones around $15–$9 could offer buying opportunities, while resistance at $27–$37.50 defines the upside path. For bold investors, the quantum computing boom offers serious upside—but volatility demands discipline.

Investor scorecard:

✔️ Pros: Momentum-filled breakout; sector-wide optimism; measurable upside resistance.

⚠️ Cons: Overbought signals; speculative fundamentals; potential for sharp retracement.