Outline

- Super Micro Computer (SMCI) faced a turbulent fiscal year in 2024, marked by significant corporate developments and financial scrutiny. The resignation of its auditor, Ernst & Young (EY), after months of friction raised concerns about the company’s financial reporting reliability. This move coincided with an investigation by the SEC, which further spotlighted issues surrounding compliance and governance.

Financial performance during fiscal 2024 revealed both challenges and areas for improvement. The company disclosed key metrics while navigating shareholder concerns and regulatory inquiries. These events demonstrated the need for strengthened risk management and transparent communication as SMCI worked to address the implications of its financial and operational decisions.

Key Takeaways

6fb01da3cff894b22f30e87b36e409f5 - SMCI faced regulatory inquiries and an auditor resignation in fiscal 2024.

- Financial reporting and shareholder communication drew scrutiny.

- Enhanced compliance measures became a critical focus.

Overview of Super Micro Computer (SMCI) in Fiscal 2024

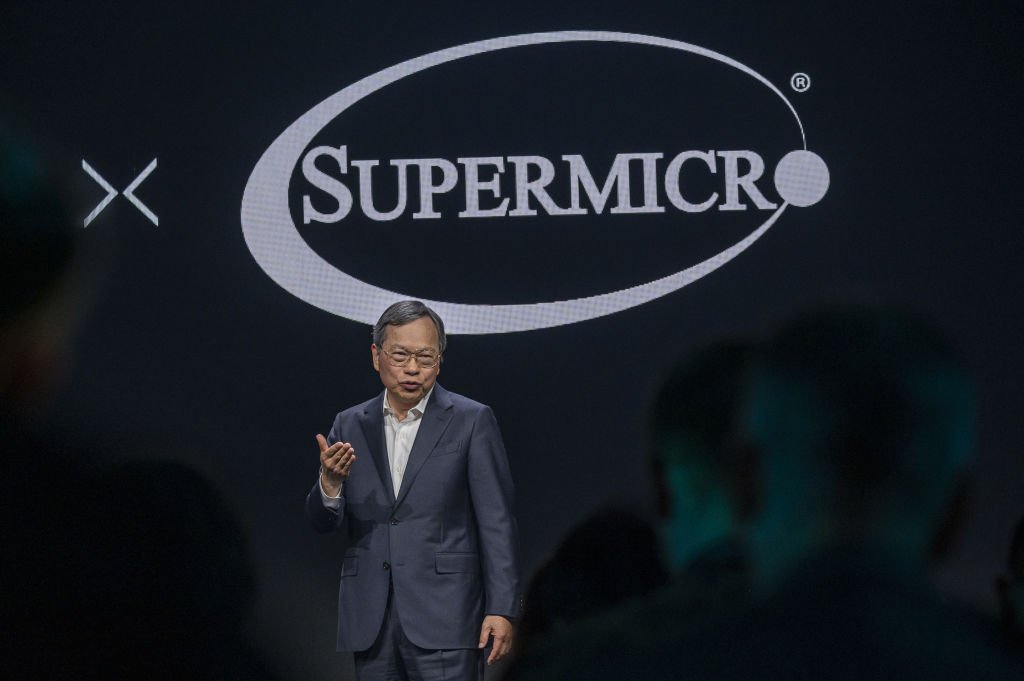

Super Micro Computer, Inc., headquartered in San Jose, California, experienced significant developments in fiscal 2024. The company, known for its advanced server solutions and focus on supporting artificial intelligence infrastructure, saw strong financial growth alongside corporate challenges impacting stockholder confidence.

Company Profile and Market Position

Super Micro Computer, Inc. (SMCI) specializes in high-performance server solutions designed for data centers, cloud computing, and artificial intelligence applications. Based in Silicon Valley, the company partners with prominent firms like Marvell Technology to stay competitive in delivering cutting-edge hardware.

In fiscal 2024, SMCI strengthened its market position by achieving substantial net sales growth of 110.4%, according to its annual report. This expansion reflects increased demand for AI-driven solutions and advanced computing products.

Stockholder sentiment, however, faced turbulence due to corporate governance uncertainties. The resignation of SMCI’s auditor, Ernst & Young, combined with a Department of Justice investigation, contributed to a dramatic 40% drop in stock value, as noted by reports on the auditor’s resignation.

Despite these challenges, the company remains a key player in Silicon Valley’s vibrant tech ecosystem. Its focus on innovation and strong industry partnerships continue to bolster its reputation as a reliable provider for AI and modern computing needs.

Fiscal 2024 Financial Highlights

Super Micro Computer’s Fiscal 2024 financial performance showcased important metrics, including revenue growth, operational efficiency, and reporting accuracy. The figures provide detailed insights into the company’s ability to balance costs, maintain liquidity, and deliver shareholder value.

Net Sales and Revenue Growth

Net Sales: Super Micro reported significant growth in net sales during Fiscal 2024, driven primarily by strong demand across its product lines and increased market penetration. Total net sales reached $8.72 billion, reflecting a year-over-year increase of 12.5%.

Cost of Sales: Cost of sales rose proportionately with revenue, reaching $6.48 billion. Despite the increase, the gross margin improved slightly, indicating effective cost management.

Net Income: Net income for Fiscal 2024 was $382 million, translating to $3.62 per common share. This increase highlights efficient financial practices in areas such as operational expenses and interest expense reduction.

Operating Expenses: Operating expenses totaled $1.97 billion, encompassing research and development, selling, and administrative costs. The year saw deliberate investments in strategic initiatives, maintaining operational efficiency.

Cash and Cash Equivalents: As of June 30, 2024, cash and cash equivalents stood at $650 million, ensuring adequate liquidity for operations and future investments.

Accounts Receivable and Inventories: Accounts receivable increased slightly to $980 million, aligned with rising net sales. Inventories declined moderately to $1.4 billion, suggesting streamlined supply chain processes.

Total Assets: The company reported total assets of $5.96 billion, reinforcing its strong financial position.

Other Income and Interest Expense: Other income contributed $18 million, while interest expenses were reduced to $14 million, reflecting improved debt management strategies.

Lines of Credit: Super Micro has access to robust lines of credit, ensuring operational flexibility and readiness for market opportunities.

SEC Investigations: Causes and Consequences

The SEC investigation into Super Micro Computer, Inc. (SMCI) emerged as one of the most critical events affecting the company in fiscal 2024. Key inquiries focused on the company’s financial disclosures, governance practices, and auditor conflicts, creating uncertainty for stockholders and raising concerns about compliance with regulatory standards.

Scope and Timeline of SEC Investigations

1907764715099156480 The SEC’s focus on SMCI began after Ernst & Young LLP, the company’s auditor, resigned on October 24, 2024. The resignation cited disagreements over financial reporting and transparency. This prompted an in-depth inquiry into SMCI’s accounting practices, including its reporting of subsidiary operations such as Super Micro Computer, Inc. Taiwan.

In response, SMCI formed a Special Committee to review the concerns. On November 5, 2024, the committee preliminarily found no evidence corroborating claims from Ernst & Young regarding misconduct or fraud. Despite these findings, the investigation delayed the company’s annual meeting and introduced risks related to potential delisting if compliance issues persisted.

The probe became even more pressing for stockholders as SMCI’s stock price plunged 33% following the resignation of its auditor, drawing additional scrutiny from independent analysts, including high-profile short sellers like Hindenburg Research. Although no direct accusations from Hindenburg surfaced, the situation underscored growing distrust among investors.

The timing of the investigations significantly impacted corporate governance. Key stockholder decisions, such as voting on board members, were delayed until clarity on the audit-related issues could be established. This disruption created ripple effects for the company, including challenges in rebuilding investor confidence during fiscal 2025.

Shareholder Communications and Reporting

Super Micro Computer, Inc. (SMCI) employs structured methods to keep its stockholders informed about its financial performance and corporate governance. These methods emphasize transparency through reporting and direct engagement with stockholders.

Annual and Quarterly Reporting Practices

SMCI provides detailed updates through annual reports and quarterly reports. These documents outline the company’s financial position, operational results, and key developments affecting stockholders’ equity and common stock valuation.

The annual report typically includes audited financial statements, a breakdown of revenue sources, and updates on strategic initiatives. Quarterly reports offer insights into short-term performance and any adjustments to financial guidance. The company adheres to SEC reporting requirements, maintaining consistency and clarity to meet regulatory standards and investor expectations.

Reporting Type Frequency Key Contents Annual Report Once a year Audited financials, major events, equity updates Quarterly Report Four times a year Short-term results, earnings, market trends Stockholder Meetings and Engagement

Stockholder engagement is facilitated through annual meetings, where management provides updates and allows for direct interaction with investors. These meetings focus on topics such as corporate strategy, financial results, and governance matters. Stockholders are encouraged to vote on significant issues, including board member elections and potential changes to executive compensation.

Beyond formal meetings, SMCI engages with stockholders through regular communication channels, including press releases and investor relations updates. This proactive approach helps maintain transparency and fosters trust within the investment community.

Risk Management and Compliance Measures

Super Micro Computer (SMCI) has implemented various risk management practices to address potential vulnerabilities and ensure operational stability.

Security Measures: The company continues to prioritize robust IT infrastructure and governance protocols to safeguard sensitive data and intellectual property. These measures include advanced encryption, multi-factor authentication, and regular system audits to mitigate cybersecurity threats and unauthorized access risk.

Credit Risk Mitigation: To manage credit exposure, SMCI evaluates customer credit profiles and enforces strict payment terms. The company also monitors outstanding accounts and leverages credit insurance where applicable to reduce potential financial losses.

Related Party Transactions: SMCI ensures transparency in related party dealings by adhering to strict reporting standards and requiring board-level approvals. These practices aim to avoid conflicts of interest and maintain compliance with regulatory requirements set forth by governing bodies such as the SEC.

Derivatives Usage: While derivatives can act as a financial risk management tool, there is no direct evidence in the available information indicating significant reliance on derivatives for hedging strategies. Any application of derivatives would likely follow regulatory standards and internal controls to prevent speculative exposure.

By continually refining its compliance measures, Super Micro strives to address regulatory expectations and maintain accountability across its operations.

For further reading:

Disclosure: This article is for informational purposes only and does not constitute financial advice. Conduct thorough due diligence before investing.